[co-author: Madison Deane, Summer Clerk]

Georgia no longer allows employers to use 14 (c) certificates from the US Ministry of Labor (DOL) to pay certain employees with disabilities below the minimum wage of $ 7.25. The law of the state and the salary, which came into force on July 1, immediately banned the wages of sub -minimies for employers who already have a DOL certificate and the practice expired until July 2027 for employers who did this. Here is what you need to know to keep them.

Fast background

The federal program 14 (c)

- Overview. In § 14 (c) of the law on Fair Labor Standards, employers can pay for certain employees with disabilities less than the minimum wage of the federal government. In order to take part in this program that aims to expand the employment opportunities for people with disabilities, employers must receive a certificate from the DOL department for wage and hours of hours (WHD).

- Workers covered. Section 14 (c) applies to employees whose earners or productive capacity is actually affected by a physical or mental disability, including those associated with age or injury. Disabilities that can affect productivity are blindness, mental illnesses, developmental disorders, cerebral paralysis, alcoholism and drug addiction.

- Subminimum wage amounts. In a report in 2023 by the US government responsibility office (GAO) it was found that more than half of the employees checked in the program between 2019 and 2021 earned less than $ 3.50 per hour, and some earned only 25 cents per hour or even less.

- Certificate types. The 14 (C) program contains specific rules for each of these types of institutions: (1) Rehabilitation programs (Community Rehabilitation Programs (CRP) or work centers; (2) Facilities for hospital or residential care (patient assistant); (3) school experience programs; and (4) Legal -oriented companies here (WHD FACT Sheet).

- Proposed endurance. The WHD spent a proposed rule in December, which would compensate for the 14 (C) program after it was found that “Subminimum wages are no longer necessary to prevent the restriction of employment opportunities for people with disabilities”. Here are six things that employers need to know (FP Insight).

Georgia's history in the program

- State program. Georgia's law once authorized the work officer to freed employers from paying the minimum wage of the state to certain employees with disabilities. Like the 14 (C) program, the state program wanted to promote the employment of people who “cannot effectively competive on the job market”.

- Enter minimum wages. Since the minimum wage in Georgia is lower than $ 7.25 per hour, employers in the state had to use the federal program to legally pay less than the minimum wage of the federal government.

- Certificate types. The state only uses 14 (c) certificates referred to by employers as community rehabilitation providers (CRPS). The data from the WHD reflect that on July 1st, seven CRPs in Georgia 14 (c) hold certificates and use around 172 people who are paid under -minimum wages.

The debate about Subminimum wages

Proponents describe section 14 (c) as a bridge for employment for people with the most important needs of support, while the opponents consider them discriminatory and exploitative. These concerns have caused a national trend to exterminate the program. According to the GAO, 16 states have eliminated the employment of the Subminimum wages since 2015.

“Payment of employees with disabilities who are less than minimum wages is an outdated and unfair practice that has no place in our state. This new law guarantees that every Georgian will be fairly compensated for his work,” said Senator Billy Hickman, a sponsor of the Dignity and Pay Act.

What is changing in Georgia?

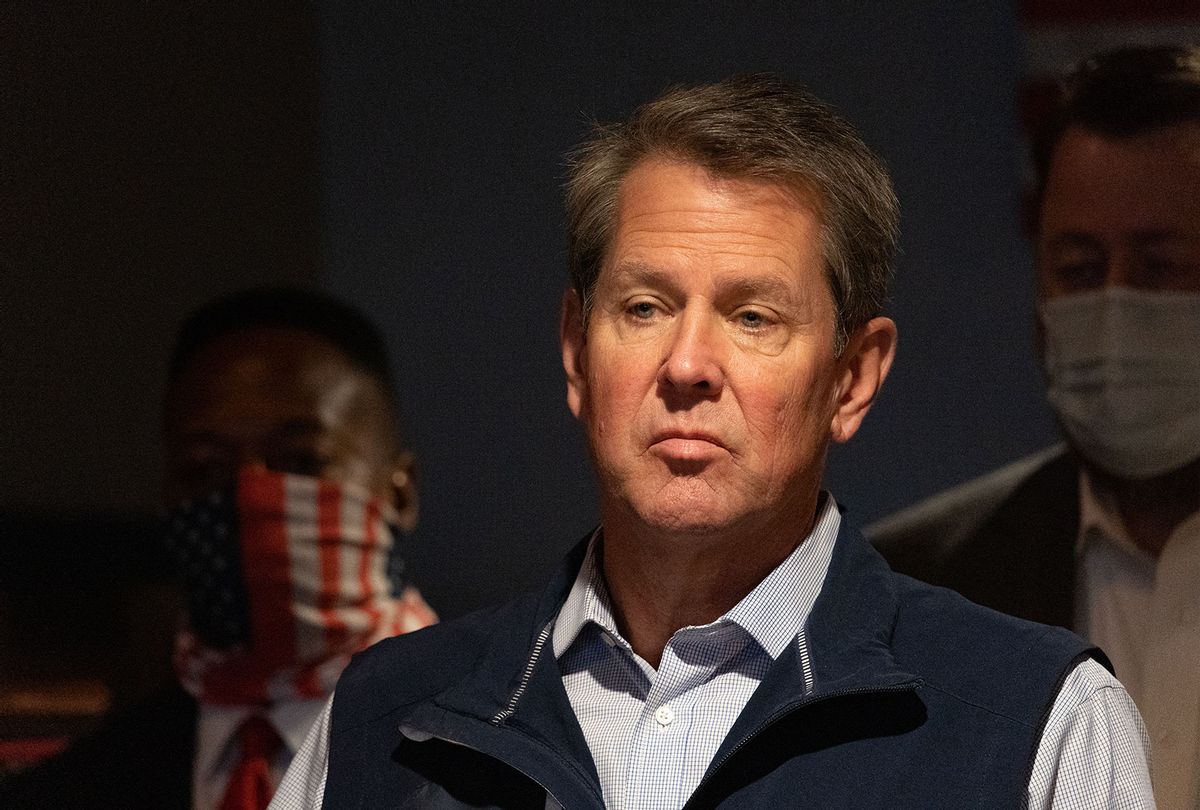

Governor Brian Kemp signed a law on May 1st (SB 55) into the law with which employer Section 14 (c) used certificates to pay employees less than the minimum wage of the federal government. The state law is also lifted, which has authorized the state to carry out a similar program. Below you will find a snapshot of what changes according to the new law.

- No new certificates. Georgia employers are not allowed to use 14 (c) certificates after July 1st.

- Certificates received before July 1st. Georgia employer who have 14 (c) certificates issued on or before July 1 (including seven CRPs, as mentioned above), you can continue to use limited use until the 2027 program is completely switched off.

- Execution restrictions. Employers are subject to the rules from the exit, employees with disabilities must pay at least half of the federal minimum wage from July 1, 2026 to the beginning of June 30, 2027 or the date on which their certificate expires. After that, the use of the program in Georgia is completely prohibited – which means that all employers have to pay all employees with disabilities at least the minimum wage of the federal government. These employers should prepare by evaluating the potential effects on their employees, their budget and their operations.